Review of Smart Money Smart Kids by Dave Ramsey and Rachel Cruze

by Debra Ross

by Debra Ross

All good parents want their kids to grow up healthy, happy, independent, and prosperous. At the same time, we hear the phrase "Too bad kids don't come with instructions" so often in our culture that it sometimes becomes an excuse for not thinking, not planning, not figuring out the methods that provide proper guidance. But relying completely on the seat of your pants to govern how you raise your kids won't cut it, especially for the prosperity part of the equation. Prosperity doesn't happen by luck, or chance. It comes from work and wisdom.

I write often about helping kids achieve the habit of living consciously. In this case, it's an easy equation: The earlier that your kids learn to work hard and apply deliberate, proven, sober strategies for managing money, the more pitfalls they'll avoid and the more financially secure they'll be. They'll have an easier life.

But Deb, you protest. I don't know how to teach them. I don't have a conscious financial plan myself; so how can I possibly help my kids develop the habits I don't have?

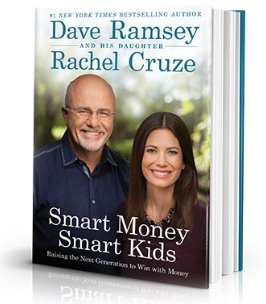

Enter Dave Ramsey and Rachel Cruze's new book Smart Money Smart Kids: Raising the Next Generation to Win with Money.

Dave Ramsey is a financial consultant whose daily 3-hour live radio call-in show is heard on over 500 radio stations throughout the U.S. and Canada. For 20 years, he has been showing millions of families how to achieve what he calls "financial peace" through his Financial Peace University class that is taught mostly in churches.

Dave's daughter, Rachel Cruze, grew up with Dave's principles for responsible money mananagement. Now in her mid-20s, she is an experienced public speaker whose passion is to convey to young people the dangers of debt and the possibilities for weath accumulation.

Financial management books are often intimidating to the average reader, but Smart Money Smart Kids summons the same energy as a highly-effective teacher: The book states a set of principles, lays out the reasoning behind them, and then makes them come alive for the audience. Its rhythm is unmatched by other books on the market that have a similar purpose.

Financial management books are often intimidating to the average reader, but Smart Money Smart Kids summons the same energy as a highly-effective teacher: The book states a set of principles, lays out the reasoning behind them, and then makes them come alive for the audience. Its rhythm is unmatched by other books on the market that have a similar purpose.

Dave and Rachel show how financial peace is within the reach of every single young person living in a free society--if they follow the right steps.

So what are those steps and principles?

Work

The main principle to teach kids is that money, and therefore the stuff we buy with it, comes from work. Dave and Rachel provide lots of examples of age-appropriate ways to help kids take pride in the work they do. They also provide practical tips for helping incentivize preschoolers, kids, and teens to want to work.

Three basic money skills

Dave Ramsey's method revolves around the three things you can (and, as he says, should) do with your money: You save some, you spend some, and you give some.

Smart Money Smart Kids provides the details for teaching younger kids Dave's Envelope System for the three categories. Eventually, kids graduate from the envelope system to start creating a budget in their teens as they manage checking and savings accounts. Smart Money Smart Kids shows you how to do this, tiny step by tiny step.

Saving

Saving is the most obvious part of what we need to teach kids in order to help them win with money. But repeating the story of the ant and the grasshopper ad infinitum won't do it. Kids are driven by short-term gratification because they haven't matured enough to take a long-term perspective. Young kids don't even realize what the future is, and that they need to plan for it. So parents are integral in helping them understand what saving is, and how to do it.

Even before kids understand why, developing the habit of always saving some of what they earn is critical to their future success, and Dave and Rachel provide easy strategies for helping both younger and older kids adopt the habit of saving. However, parents do need to understand the why of saving at a deeper level in order to be able to convey it best to kids, and this is where Smart Money Smart Kids excels. Some of the book's clearest and most inspiring writing focuses the reader's attention beautifully on what saving makes possible.

Spending

As focused as they are on the need to avoid debt, you might think that the Ramsey-Cruze duo would be mostly teaching austerity--that is, how to avoid spending. But that's not the case at all. Okay, when you're an adult trying to work your way out from under a mountain of debt, that's true, you do need to avoid spending on anything but the necessities of life.

But with KIDS, this book teaches a different strategy: In fact, Dave and Rachel want you to encourage your kids to spend a portion of what they earn, on what they want. Yes! The pleasure of money getting you the things you want is integral to learning how to manage it wisely, especially when you're a kid. The happier you are with the results of your work, the harder you'll work. So giving your kids the latitude to spend independently--you want them to make their mistakes when you're there to catch them if they fall--is critical. Readers will find this a surprising, but satisfying, element of Dave's strategy.

Giving

The chapter in Smart Money Smart Kids about the third aspect of money management, giving, is the one I found least satisfying. When Dave and Rachel address the other aspects of money management--saving and spending--the reasons why they employ certain strategies is crystal clear. But how giving away part of your money leads to winning overall was not well defined here. Dave and Rachel base their rationale for the necessity of giving from a Christian Biblical perspective. For evangelical Christians, people are to regard themselves more as stewards of God's wealth than as owners of their own, and part of responsible stewardship in this worldview requires the generosity that God commands. Smart Money Smart Kids does provide some nice illustrations of why it's detrimental for a person to be completely self-absorbed, and I liked their stories about the very real pleasures of giving that they have found true in their lives. But reasons for why giving is an integral part of winning with money kind of gets lost. For religious Christians, Dave and Rachel's rationale is probably enough. Those who are not will want more.

So I'm asserting a little editorial privilege to supply some reasoning that I feel is often missing from this discussion in our culture.

Give of your excess, not of your essence. Have you heard this expression? It encapsulates this idea well, I think. When you're generous with the extra value you have created and give it to someone who can make better use of it than you could, you're extending your efficacy in the world. When you're wisely generous, your money makes the world a better place in a way that you couldn't accomplish simply by your own efforts. Consequently, you and your children get to live in that world that is now a tiny bit better off, thanks to you. When you give with this attitude, it's easy to get hooked on generosity.

And then, by focusing your attention so positively on what money can do, it makes you want to work harder--in part, so you can find the right ways to be generous, to make your efficacy in the world travel as far as possible.That's why, I think, having a philosophy of regular generosity is so effective in helping people win with money overall.

The book's method

The book's method

Have you ever traced back the path you took to become the you that you are now? You see all of these those forks in the road where the outcome could have been different, right? On the flip side of that, I sometimes wish I had a telescope to my kids' future, to see those forks in the road that will be in their paths, so I could give them wisdom at just the right moment.

This book works like that. Rachel was born in the year that Dave and his wife Sharon declared bankruptcy. So she spent her childhood living the Dave Ramsey method for scraping out of debt and into first financial stability and then prosperity. Smart Money Smart Kids brings us the story in living color of what that was like. And let me tell you: These Tennesseeans can sure tell a vivid story. They've got that engaging flair that is so common to the rhythms of the South, with the main point saturated in every line so that you can't help but get the message even as the tension builds sentence by sentence.

Because Rachel grew up to be an extremely articulate adult, we see the outcome of teaching these principles to kids right up close and personal. She has lots of opinions about what worked, why, and what it has done for her--and what it can do for your kids, too. The book seems to have been written with a tag-team approach, with Rachel serving as the guiding force for the organization and message, and Dave ducking in with commentary and stories when appropriate.

The only part of the tag-team approach that I didn't like was the fonts the editors chose for the book: The design sort of offended my own editorial sensibilities. Rachel's writing is in a serif font, and Dave's is in a sans serif font. I see why they did that, to make it super-clear whose voice was coming off the page. But I found it hard on the eyes: I expect my printed material in Times Roman or one of its cousins. Sans serif font is for the web. Frankly, I don't think the font switching was necessary: Dave's and Rachel's voices are clear and distinct. (And Rachel writes better than Dave does. :-) )

Special subjects

After laying out the basic principles and steps for teaching kids money management, Dave and Rachel address specific situations. The longest chapter of the book is College: Don't Graduate from I.O.U. If you thought that sending your kids to college necessarily involves student loans, you're wrong. Dave and Rachel provide both practical strategies and inspiration for sending your kids to college debt-free.

After laying out the basic principles and steps for teaching kids money management, Dave and Rachel address specific situations. The longest chapter of the book is College: Don't Graduate from I.O.U. If you thought that sending your kids to college necessarily involves student loans, you're wrong. Dave and Rachel provide both practical strategies and inspiration for sending your kids to college debt-free.

One other chapter is devoted to budgeting, for teens and beyond; there is even a section for planning weddings. The chapter Family: Put the FUN in Dysfunctional addresses family structures other than the traditional two-parent-two-point-three-child family, and the special challenges those often entail--like in cases of divorce, blended families, single parents, and grandparents raising grandchildren. I would have loved to have seen more than a few paragraphs on the special financial needs of special needs children, because it seems that there is a lot more to say on that subject, but of course a book can only be so long. (I hope they consider addressing that subject elsewhere.)

More is caught than taught

An assertion both Dave and Rachel make frequently in Smart Money Smart Kids is one that family therapists and developmental psychologists have told us for a long time: Kids learn more from what you do than from what you say. So it is important that you make every effort to practice excellent money habits yourself as you're going through this process with your kids.

If you aren't quite there yet, never fear! Smart Money Smart Kids is certainly useful for parents who have their financial plans firmly in place and still need to know best how to convey these concepts to kids. But parents who themselves are struggling with money issues will probably get the most value out of this book. As simple as the strategies seem, they're not easy. You'll hold your kids' hands--and Dave and Rachel will hold your hand--as your family follows the steps together to achieve financial well-being.

If you aren't quite there yet, never fear! Smart Money Smart Kids is certainly useful for parents who have their financial plans firmly in place and still need to know best how to convey these concepts to kids. But parents who themselves are struggling with money issues will probably get the most value out of this book. As simple as the strategies seem, they're not easy. You'll hold your kids' hands--and Dave and Rachel will hold your hand--as your family follows the steps together to achieve financial well-being.

© 2014, KidsOutAndAbout.com

Debra Ross is publisher of KidsOutAndAbout.com.

To see all of the local regions in which KidsOutAndAbout is published, click here: .

.